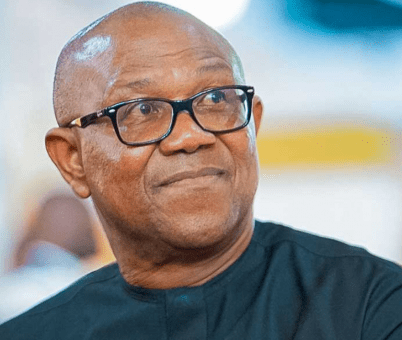

Peter Obi’s Companies and Investments: An Example of Market Entry for Diaspora Founders

If you have been paying attention to the trending queries on the internet lately, you’ll notice that a staggering number of Nigerians are asking one specific question: “What companies does Peter Obi actually own?” It is a fair question. In a world where many leaders have wealth that seems to appear out of thin air, Peter Obi’s business portfolio is a subject of intense fascination.

Learn How to Leverage Your Story through our Story To Asset Framework.

However, for the Diaspora founder or the “Sovereign Leader” in training and empowerment education, the list of his companies is more than just trivia; it is a roadmap. It tells a story of how to enter a difficult market, build trust where none exists, and create an institution where others see only chaos.

At AClasses Academy, we believe that success leaves footprints. If we look closely at the “Obi Portfolio,” we aren’t just looking at bank accounts; we are looking at a masterclass in Institutional Building.

Here is the breakdown of the “Obi Engine Room” and the massive lessons you can apply to your own business journey today.

The “Obi Portfolio”: A Glimpse into the Engine Room

While Peter Obi is famously prudent in his personal life, his business footprint is institutional. He didn’t just “invest” in companies; he sat on their boards and shaped their governance.

He didn’t look for “get-rich-quick” schemes; he looked for sectors that were essential to the growth of a nation. Here are the top questions you are probably seeking Answerers for about Peter Obi:

- Fidelity Bank PLC: This is perhaps his most famous institutional role. He didn’t just hold shares; he was the youngest Chairman in the bank’s history. Under his leadership, he helped steer the bank through the complex consolidation periods of the Nigerian financial sector, turning it into a top-tier institution.

- Next International Nigeria Ltd: This is his primary vehicle for global trade and consumer goods. It is where his early roots as a “Trader” were codified into a multi-national operation that manages massive supply chains.

- Guardian Express Bank: Another strategic move into the financial services sector, which eventually merged with other entities to form the larger banking structures we see today.

- Future View Securities: A deliberate entry into the capital markets. This highlights his understanding that wealth is not just about cash on hand, but about Asset Organization and stockbroking.

- Chams PLC & Card Center Nigeria Ltd: These represent an early entry into the technology and identity management space. Long before “Fintech” was a buzzword, Obi was invested in the infrastructure of digital identity and smart cards.

- International Breweries: A notable equity stake that became a massive success story in what we call “Patient Capital.” Now, let consider some lessons to take away.

Solving the “Institutional Void”

In the Diaspora, we often take “institutions” for granted. When you open a business in London, Milan, or New York, you assume the “rails” are already laid down. You assume the electricity will work, the bank will process your payment, and the courts will protect your contract.

However, in many emerging markets, these systems are “void” or broken. This is what economists call the Institutional Void.

The Obi Strategy: Peter Obi didn’t just complain about the lack of reliable banking or the difficulty of logistics; he invested in the very companies that provided those services. He realized that if the system is broken, the person who builds the “fix” owns the market.

How to apply this as a Founder:

Don’t just look for a “gap in the market” (like selling a product). Look for a “void in the system.” If your community lacks a reliable way to learn leadership, manage capital, or tell their story, you shouldn’t just be a “coach.”

You must become the Institution that provides the infrastructure for that wisdom. That is the core mission of AClasses Academy. We are filling the void left by traditional education, and we are happy to collaborate with professionals across different countries of the world.

The “Supermarket” Approach to Market Entry

When Peter Obi brought the “Next” brand to Nigeria, he did more than just open a store. He revolutionized how people thought about retail. At the time, most shopping happened in “scattered” open-market models where pricing was inconsistent, and quality was a gamble.

Obi introduced the centralized, organized, and transparent Supermarket Model. He brought structure to the struggle.

The Lesson for Founders:

Many Diaspora founders try to enter the market by doing exactly what everyone else is doing, just slightly better. But the “Obi Way” is to bring Standardization.

- The Strategy: Whatever service you provide, whether it is healthcare consulting, financial coaching, or trade, bring a level of Institutional Organization that makes you stand out.

- The Human Edge: When you provide a “Supermarket” level of reliability in an “Open Market” environment, you win by default. People don’t just buy your product; they buy the Peace of Mind that your system provides.

Patience as a “Capital” Asset

In a world addicted to 24-hour success stories, the Peter Obi business story is a reminder of the power of Time. His investment in International Breweries is a perfect example.

He didn’t look for a quick flip. He invested personal conviction into a project that took years, even decades, to yield its most massive returns.

The Lesson for Founders:

We often overestimate what we can do in one year and vastly underestimate what we can build in ten years.

The Strategy: Treat your Story to Asset journey like a 10-year bond. Your first course or your first institutional program might not make you a millionaire by next Tuesday, but you are building the Infrastructure of your Authority.

The ROI: Like the Obi investments, your codified wisdom will pay dividends long after the initial work is done. Real wealth is built on “Patient Capital.”

4. Transparency as a Competitive Advantage

There is a reason people search for Peter Obi’s companies more than almost any other African businessman. It is because he has associated his brand with Transparency and Probity.

See also From Trading to Transparency: Lessons in Economic Sovereignty from the Peter Obi Model

In markets where “hidden hands” are common, being the person who says, “Here are the numbers, here is the process,” is a revolutionary act.

The Human Lesson:

For the Diaspora founder, transparency is your “Trust Engine.” If your methodology is hidden in your head, no one can trust it enough to invest in it. But when you Codify your wisdom into a framework that others can see, touch, and follow, you are practicing the “Obi Model.”

Transparency doesn’t just make you a “good person”; it makes you a Sovereign Leader whom others are willing to follow.

Transitioning from “Trader” to “Chairman”

Peter Obi famously says, “I am a trader.” This humility is his strength, but his trajectory shows he didn’t stay just a trader. He understood that a trader manages transactions, but a Chairman manages Systems.

A trader has to be at the market every day to make money. A Chairman builds a board, a team, and a set of rules that allow the business to grow while he is focused on the “Big Picture.”

How to Action This:

Are you still “trading” your hours for dollars? Or are you building a “Board” for your own life?

- The Move: Start treating your intellectual property as a corporate asset.

- The Tool: Use a Digital Sanctuary (like your own Academy) to house your knowledge. This allows you to move from the “Market Stall” of 1-on-1 consulting to the “Boardroom” of institutional influence.

Conclusion: From Looking at the List to Joining the List

It is fascinating to look at a list of companies owned by a successful leader. But the real “Sovereign” move is to stop being a spectator and start being an architect. You have to ask yourself: “What will my list of assets look like in ten years?”

Peter Obi’s companies are successful not because of luck, but because they were built on the foundations of Transparency, Prudence, and Institutional Thinking. These are not “secrets” reserved for the elite; they are skills that you can learn and systems that you can build.

Also Peter Obi’s Business Empire: How Nigeria’s Leading Entrepreneur Builds Wealth and Legacy

At AClasses Academy, we don’t just want you to admire the “Obi Portfolio.” We want to help you build your own. We want to help you take your “Trading” skills and turn them into Institutional Assets that will serve your family, your community, and the Diaspora for generations.

Ready to Build Your Own Portfolio?

Stop searching for other people’s success and start codifying your own. Your journey from “Expert” to “Owner” starts with a single step: Taking your story and turning it into an asset. Book Your Institutional Audit Today