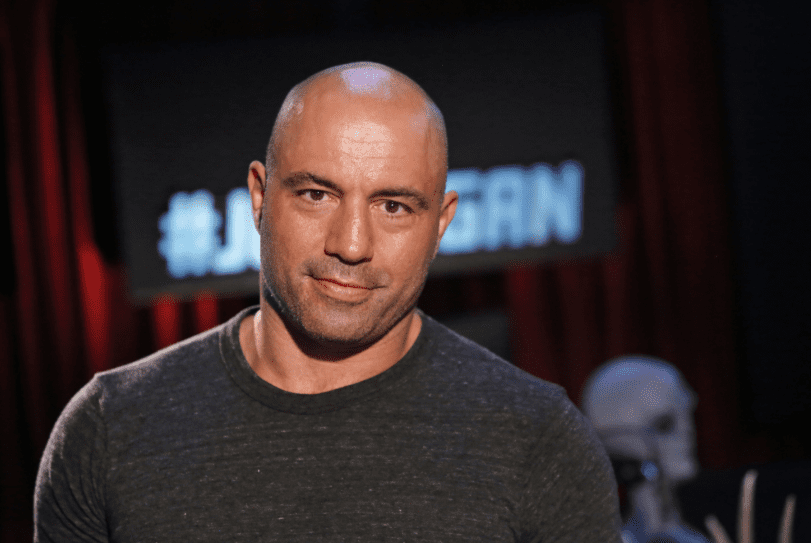

The Joe Rogan Net Worth Myth: Why “Asset Ownership” Matters More Than Your Bank Balance

If you go to Google today and type in “Joe Rogan Net Worth,” you will see a flurry of numbers. Some sources say $200 million, others say $250 million, and by mid-2026, some estimates are pushing toward the $300 million mark. But here is the truth that Joe Rogan understands, and most people miss: Joe Rogan doesn’t care about his net worth. He cares about his Masters.

Learn How to Leverage Your Story through our Story To Asset Framework.

In the world of high-level business and institutional building, “Net Worth” is often just a snapshot of your past. It tells us how much you have made. But Intellectual Property (IP) Ownership tells us how much power you have over your future.

At AClasses Academy, we teach Diaspora leaders to stop chasing a high bank balance and start chasing Asset Sovereignty. This is the deep dive into why Joe Rogan is actually “wealthier” than the numbers suggest.

1. The Trap of the “Big Paycheck”

Most people saw Joe Rogan’s 2020 deal with Spotify as a $100 million “salary.” They saw the 2024 renewal, estimated at $250 million, as a “raise.”

If you think like an employee, you see a paycheck. But if you think like a Sovereign Architect, you see a Licensing Fee. The Distinction Between “Earnings” and “Assets”:

- Earnings: Money paid to you for your time (a salary, a gig, or a standard endorsement). If you stop talking, the money stops flowing.

- Assets: A codified piece of Intellectual Property that earns money regardless of whether you show up to work today.

When Rogan signed with Spotify, he didn’t sell his podcast. He licensed the right to distribute it. By early 2026, we see the brilliance of this move.

Because he maintained ownership of his “Masters” (the original recordings and the brand), he was able to return his show to YouTube and Apple Podcasts while still collecting the massive Spotify check.

See also How to Monetize Your Podcast with Spotify

The AClasses Lesson: If you are a consultant or an expert, you are likely “earning” a high net worth. But do you own the “Masters” of your methodology? Or does your employer own the systems you created?

2. IP Ownership: The True Measure of Wealth in 2026

In 2026, the global economy has shifted from a “Material Economy” to a “Knowledge Economy.” In this world, Intellectual Property (IP) is the new Gold Standard.

What is Intellectual Property (IP)?

Simply put, IP is the “Creation of the Mind” that has been codified into a legal asset.1 For Joe Rogan, it’s The Joe Rogan Experience (JRE) brand and his library of over 2,000 episodes.

For you, it might be your unique way of managing a hospital, your specific strategy for crowdfunding, or your methodology for mental health.

Why IP Beats a Bank Balance:

- Inflation Proof: Cash loses value every year. A proprietary system (IP) increases in value as more people use it and recognize the brand.

- Collateral Power: In 2026, you can leverage your IP (your courses, your trademarks) to secure funding for bigger institutional projects.

- Generational Transfer: It is very easy for a family to spend $1 million in cash. it is much harder to “spend” a codified university or a licensed methodology that brings in royalty checks every month.

“Your bank balance is what you have. Your IP is what you are worth to the world.”

3. The “Masters” Mentality: Following the Taylor Swift and Joe Rogan Model

To understand why Rogan is so successful, we have to look at the music industry. For decades, artists were “rich” but “poor.” They had millions in the bank, but they didn’t own their Master Recordings. When they wanted to use their own songs in a movie or a commercial, they had to ask a “Landlord” (the Record Label) for permission.

Joe Rogan and Taylor applied the “Masters” mentality to podcasting.

- He owns the feed.

- He owns the archives.

- He owns the trademark.

Because he owns the “Source Code,” he can never be truly “canceled” or “fired.” He can simply take his asset and move it to another “neighborhood” (platform).

4. From Expert to Institution: How to Build Your Own “Masters”

This is where we move from the “Myth of Joe Rogan” to the Reality of Your Business. If you are a Diaspora leader, you are currently sitting on a goldmine of Tacit Knowledge, wisdom gained through years of practice that hasn’t been written down yet. If you leave your job tomorrow, that “Net Worth” goes to zero.

Here is the Story to Asset Roadmap to move from a bank balance focus to an asset focus:

Step 1: Codify the “Tacit” (The Extraction Phase)

You must move your wisdom from your “head” to a “format.”

- Action: Instead of just giving advice, write down the 5 steps you use to get results.

- Asset created: A proprietary framework.

Step 2: Legalize the Brand (The Protection Phase)

Like Rogan trademarked “JRE,” you must trademark your signature program. This turns a “good idea” into a “legal entity” that can be bought, sold, or licensed.

Step 3: The Sovereign Library (The Storage Phase)

Host your wisdom on your own platform. Using tools like LMS (Learning Management System) to ensure that you aren’t just a “tenant” on YouTube or LinkedIn. You own the building.

Step 4: The Royalty Model (The Distribution Phase)

Once your “Masters” are built, you stop selling “hours.” You start selling “Access.”

- The Rogan Move: You license your course to organizations for a yearly fee.

- The Beast Move: You use your IP to launch physical products (books, workshops, physical tools).

5. The 2026 Reality Check

Let’s look at the numbers again. If Joe Rogan has $250 million in the bank, that is impressive. But if he has a library of content that generates $60 million a year in ad revenue, without him having to lift a finger, that is Institutional Power.

As a Diaspora leader, your goal shouldn’t be to hit a “Net Worth” of $1 million. Your goal should be to build a Sovereign Asset that generates value for the community and income for your family, forever.

Conclusion: Whose Name is on the Asset?

The Joe Rogan story isn’t about a guy with a microphone who got lucky. It’s about a man who refused to be an employee. He understood that in the Digital Age, ownership is the only true form of security.

The “Net Worth” hunters will always be chasing the next paycheck. But the Sovereign Industrialists, the ones we are building at AClasses Academy, are focused on building assets that outlast them.

Are You Ready to Own Your Masters?

Stop selling your time to build someone else’s institution. It’s time to excavate your story, codify your wisdom, and build your own “Sovereign Sanctuary.”

Start Your Story to Asset Audit Today and join the ranks of owners, not just earners.