Financing Africa’s Agribusiness Revolution: A Trillion-Dollar Investment Opportunity

In the heart of Africa’s agricultural landscape is a growing opportunity, one that could catalyze economic growth, alleviate poverty, and ensure food security for millions of people. As incomes rise and urbanization sweeps across the continent, investments in agribusiness are poised to transform into a trillion-dollar industry by 2030, up from a modest $313 billion in 2010.

Want to learn more about storytelling? Start by downloading the first chapter of The Storytelling Mastery.

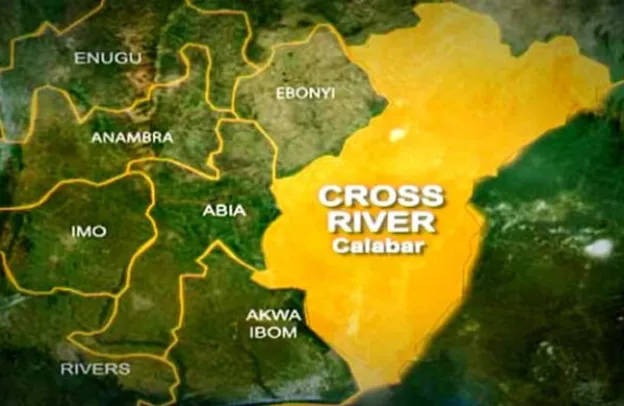

However, this potential prosperity is not without its challenges. A recent survey conducted among 75 agribusiness firms in Nigeria reveals a litany of obstacles, from crumbling infrastructure to regulatory red tape, stifling the industry’s growth.

But perhaps the most glaring issue is the financing gap, estimated at a staggering $11 billion annually across Africa.

In Nigeria alone, the working capital needs for agribusiness hover between $4.6 billion and $6.5 billion per year, illustrating a dire need for capital infusion to unlock the sector’s full potential.

A comprehensive study delving into the financing needs of both farmers and off-farm agribusiness enterprises sheds light on the critical role of different stakeholders in catalyzing sustainable and inclusive finance.

By leveraging multiple research methods, including targeted surveys and interviews with key industry players, the study provides invaluable insights into the demand for financial products and services, as well as the constraints hindering access to capital.

At the heart of the issue lies the imperative need for working capital, essential for everything from purchasing seeds to maintaining logistics networks. Yet, despite the pressing demand, many value chain actors struggle to secure financing, grappling with high lending rates and onerous documentation requirements.

Even in countries like Ghana and Nigeria, which boast relatively developed financial systems, access to finance remains elusive for the majority. Smallholder farmers and agricultural SMEs find themselves particularly marginalized, as commercial banks prioritize larger, more established enterprises.

This financing gap not only stymies individual businesses’ growth but also hampers broader economic development and innovation within the sector.

Check out also The Impact of Government Policies on Small and Medium-Scale Farming in Nigeria

Yet, amid these challenges, glimmers of hope emerge. A growing number of investment funds, both domestic and foreign, are recognizing the immense potential of Africa’s agribusiness sector. From private equity to impact investing, these funds are injecting much-needed capital into the industry, targeting a diverse array of enterprises, from smallholder farmers to large agribusiness companies.

Multinational corporations, too, are stepping up to the plate, leveraging their resources to support local farmers and businesses. By providing technical assistance and forging long-term partnerships, these corporations are not only securing their supply chains but also empowering local communities and driving sustainable growth.

Moreover, government and donor interventions are playing a pivotal role in incentivizing commercial banks to experiment with innovative financial products and services. Initiatives such as the Nigeria Incentive-Based Risk Sharing Agricultural Lending Scheme (NIRSAL) and credit risk guarantee schemes in Ghana and Sierra Leone are paving the way for greater financial inclusion and accessibility.

As Africa stands on the cusp of an agribusiness revolution, the imperative for concerted action has never been clearer. By bridging the financing gap, fostering innovation, and fostering strategic partnerships, stakeholders can unlock the sector’s full potential, driving economic prosperity and ensuring a sustainable future for generations to come.

The Type Of Financing Needed for Africa’s Agribusiness Revolution

Africa’s agribusiness revolution requires a diverse array of financing to unlock its full potential and address the multifaceted needs of the sector. Firstly, working capital financing is paramount to facilitate day-to-day operations across the agricultural value chain.

Smallholder farmers, agribusiness enterprises, and input suppliers require capital to procure seeds, fertilizers, and other inputs, as well as to cover labor and logistics costs.

Moreover, working capital financing enables off-farm businesses to manage inventory, transportation, and marketing expenses, ensuring smooth operations and timely delivery of goods.

See also Best Marketing Strategies for Small and Medium-Scale Farmers in African Agribusiness.

Access to affordable and flexible working capital loans is crucial, particularly for small and medium-sized enterprises (SMEs), which often face liquidity constraints and seasonal fluctuations in cash flow.

Additionally, investment capital financing is essential to drive long-term growth and innovation in the agribusiness sector. This includes financing for capital expenditures such as land acquisition, infrastructure development, machinery, and technology adoption.

Agribusinesses need capital to invest in modern farming techniques, value-added processing facilities, and distribution networks to enhance productivity, quality, and market competitiveness.

There is a growing need for specialized financial products and services tailored to the unique requirements of agribusinesses. Value chain financing mechanisms, such as supply chain finance and warehouse receipt systems, can help address working capital needs by providing financing against collateralized inventory.

Agricultural insurance products mitigate production risks associated with adverse weather conditions, pests, and diseases, providing financial protection to farmers and agribusinesses.

Moreover, leasing arrangements for agricultural equipment and machinery offer a cost-effective alternative to outright purchase, enabling businesses to access modern technologies without heavy upfront investments.

Digital financial services, including mobile banking and electronic payment systems, improve financial inclusion and access to credit for remote and underserved agricultural communities.

Collaborative efforts between governments, financial institutions, development agencies, and private sector stakeholders are equally essential to develop and promote innovative financing solutions.

These are some of what will catalyze Africa’s agribusiness revolution and foster inclusive economic growth. With that said, what are some key areas of profitability? Let’s check them out.

You might also want to see Transforming Africa’s Food Security Crisis into Agribusiness Prosperity

Three Areas Of High Profitability In African Agribusiness

In African agribusiness, several sectors hold significant potential for high profitability. If you are an investor or willing to profit from African agribusiness opportunities, here are three areas that need to stand out for you:

Export-Oriented Cash Crops:

Many African countries possess natural advantages for cultivating cash crops such as cocoa, coffee, tea, and cotton. These crops are in high demand globally, offering lucrative opportunities for export-oriented agribusiness ventures.

For instance, countries like Côte d’Ivoire, Ghana, and Ethiopia are major producers of cocoa, with their products being essential commodities in the global chocolate industry.

Similarly, Kenya’s tea exports contribute significantly to its economy. Profitability in this sector is driven by consistent global demand, relatively stable prices, and the potential for value addition through processing and branding.

Horticulture and Fresh Produce:

The increasing urbanization and rising incomes in Africa have spurred demand for fresh fruits, vegetables, and other horticultural products. Agribusinesses specializing in the production and distribution of these items can capitalize on this growing market demand.

With proper infrastructure and logistics support, particularly cold chain facilities, businesses can extend the shelf life of perishable goods and access both domestic and export markets.

Countries like Kenya, Tanzania, and South Africa have emerged as key players in the horticulture sector, exporting a diverse range of produce to international markets. High profit margins in horticulture are often driven by premium pricing for quality products and favorable export opportunities.

This is not to disregard the local demands of the African rising middle class that is equally asking for these products.

Livestock and Poultry Farming

Livestock and poultry farming presents another avenue for profitable agribusiness ventures in Africa. With a growing population and changing dietary preferences, demand for meat, eggs, and dairy products is on the rise across the continent.

In the words of Nomore Nhema, a Zimbabwean poultry farmer we recently interviewed on the Obehi Podcast, “Poultry farming is lucrative in Africa, and you need to aim for quality products”.

See the full podcast interview on our YouTube channel: Elevate Your Poultry Business through Strategic Marketing – Nomore Nhema, A Zimbabwe Poultry Farmer

Nomore Nhema is the founder of Nhema Chickens in Zimbabwe and according to Nhema, they supply their poultry products to countries such as New Zealand, Canada, the US, the UK, and Australia.

Agribusinesses that invest in modern farming practices, animal husbandry techniques, and value-added processing can capture significant market share. Moreover, by leveraging technology for feed formulation, disease control, and genetic improvement, businesses can enhance productivity and profitability.

Countries like Nigeria, Kenya, and Uganda have vibrant livestock sectors with opportunities for both domestic consumption and export.

Profitability in this sector is often driven by efficiency in production, effective disease management, and access to quality feed and genetics.

What I would like to add to that is that these sectors offer promising avenues for agribusinesses to thrive and generate high returns on investment in Africa. However, success in these areas requires careful market analysis, strategic planning, and investment in technology, infrastructure, and human capital.

Additionally, businesses must navigate regulatory frameworks, market dynamics, and environmental challenges to sustain profitability in the long term.

Want to learn more about storytelling? Start by downloading the first chapter of The Storytelling Mastery.